Tungsten prices soar! How can the "teeth of industry" break through the price ceiling?

Tungsten, the strategic metal hailed as "the teeth of industry," is currently sending shockwaves through global markets with its astonishing surge in prices. Prices of major tungsten products have surged across the board by more than 120%, with the highest increase exceeding 140%.

As an indispensable core material in modern industry, sharp fluctuations in tungsten prices are profoundly impacting sectors ranging from aerospace and national defense to machining and energy extraction.

Get to know tungsten: It's more than just a "light bulb filament."

Tungsten is far more than just the thin filament found in light bulbs, as many people imagine. It is the metal with the highest melting point in nature, reaching an astonishing 3,422°C, and its density is nearly twice that of gold. With a hardness of 7.5 on the Mohs scale—comparable to diamonds—these exceptional properties make tungsten an indispensable "tooth" in modern industry.

From cemented carbide tools to military-grade products, from oil drilling to aerospace applications, tungsten is everywhere. A smartphone’s vibration motor relies on tungsten alloy counterweights; critical components of an automobile engine are precisely machined using tungsten steel tools; and the core of an armor-piercing bullet is crafted from high-density tungsten alloy to guarantee unmatched penetration power.

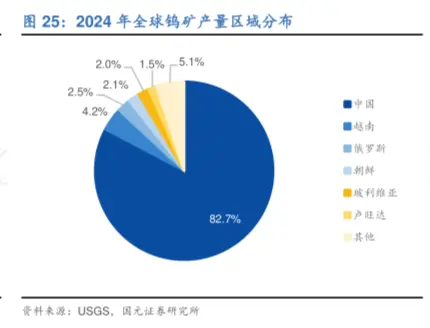

More critically, tungsten is a non-renewable strategic resource. Globally, tungsten reserves are highly concentrated, China, Russia, and Vietnam together hold more than 60% of the world's reserves and over 80% of global production. This scarcity and strategic nature have set the stage for today's price fluctuations.

Latest tungsten prices: A wild curve that has doubled in just one year

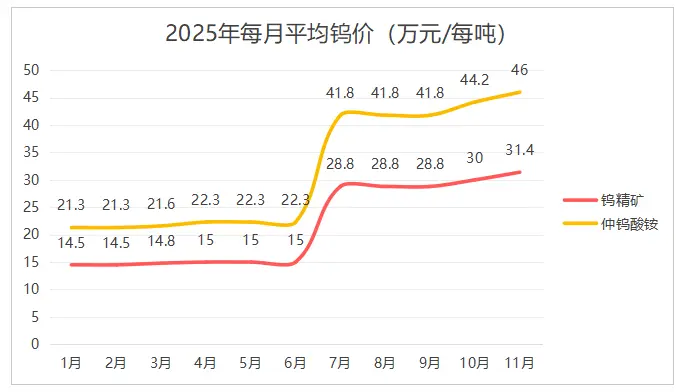

On November 14, 2025, the tungsten market continued to remain strong. Industry data showed that prices of key tungsten products have surged across the board by more than 120% so far this year, with the highest increase exceeding 140%.

Data source: Zhongtung Online

Data statistics cutoff date: November 14, 2025

All figures are estimates and are for reference only.

Prices remained relatively stable from January to March 2025, but began accelerating upward starting in April due to shrinking supply and surging demand—particularly in sectors like defense and new energy. By August and September, prices reached their peak. From October to November, prices remained high, with tungsten concentrate, APT, and tungsten powder breaking through 300,000 yuan/ton, 460,000 yuan/ton, and 700 yuan/kilogram, respectively.

Multiple factors are driving prices higher.

(1) Supply Contraction: Tightening at the Source

The policy side strictly controls the total extraction volume.

In 2025, the national quota for the first batch of tungsten concentrate mining was set at 58,000 tons, a reduction of 4,000 tons compared to the same period in 2024, representing a year-on-year decline of 6.45%. Jiangxi, the main producing region, saw its quota cut by 2,370 tons, while low-producing areas such as Hubei and Anhui had their quotas reduced directly to zero. (China Tungsten Online)

Environmental inspection crackdowns lead to further tightening of supply.

Jiangxi and Hunan's small- and medium-sized mines have seen production halted at over 30% due to a 40% surge in transformation costs. Meanwhile, the domestic tungsten concentrate industry’s operating rate has dropped to 35%, with weekly output declining by approximately 200 tons. (Yangtze Colored Metals Network)

Deteriorating resource endowments exacerbate supply constraints.

Domestic tungsten mines have seen their average ore grade drop from 0.42% in 2004 to 0.28% in 2024, while mining costs continue to rise. Globally, aging mines are grappling with declining grades and limited production capacity. (China Tungsten Online)

(II) Demand Expansion: Emerging Applications Ignite the Market

Demand for photovoltaic tungsten wires experiences explosive growth.

The penetration rate of photovoltaic tungsten wire in silicon wafer cutting surged from 20% in 2024 to 40% in 2025, with global demand expected to exceed 4,500 tons. (China Tungsten Online)

National-level major projects become a new engine for demand.

The demand for drone structural components in the defense industry, power infrastructure construction, and maintenance continues to grow. Meanwhile, the advancement of national-level mega-projects such as the Yarlung Tsangpo Hydropower Station and the new Tibet Railway—along with the simultaneous upgrades to highway trunk and branch routes supporting these critical infrastructures—has created a substantial incremental market for cemented carbide tools. (China Tungsten Online)

Fusion commercialization sparks future demand

From international experimental facilities to a clear domestic roadmap for fusion energy development, all point to a well-defined, multi-thousand-ton-level demand for the future. (China Tungsten Online)

(III) Market Sentiment and Trade Dynamics

Market sentiment is strongly characterized by reluctance to sell.

Mine spot inventories have dropped to 15 days' worth of usage, compared to 45 days during the same period last year. Upstream mining companies are tightly controlling the volume of spot supplies released, with some mines offering just 200 tons of spot goods per week. (Economic Observer)

Export controls are reshaping global trade flows.

In February 2025, China imposed export restrictions on primary products such as ammonium paratungstate, tungsten oxide, and tungsten carbide. From January to July 2025, China's exports of tungsten products fell by 34.56% year-on-year, while imports surged by 45.57%. (China Tungsten Online)

Behind this price storm lies a fundamental shift in supply and demand fundamentals—reduced mining quotas, stricter environmental regulations, surging new demands from the photovoltaic and defense industries, and adjusted export policies—all of which are jointly driving tungsten prices into a historic upward trajectory. The strategic value of tungsten is now being recognized by the market to an unprecedented degree. This isn’t just about rising prices—it’s a fundamental reassessment of its true worth.

The data in this article are compiled from publicly available industry sources and are provided for reference purposes only. The content is intended for industry discussions and does not constitute any investment advice. If you find any infringement, please contact us for removal.

Previous Page